All Categories

Featured

Table of Contents

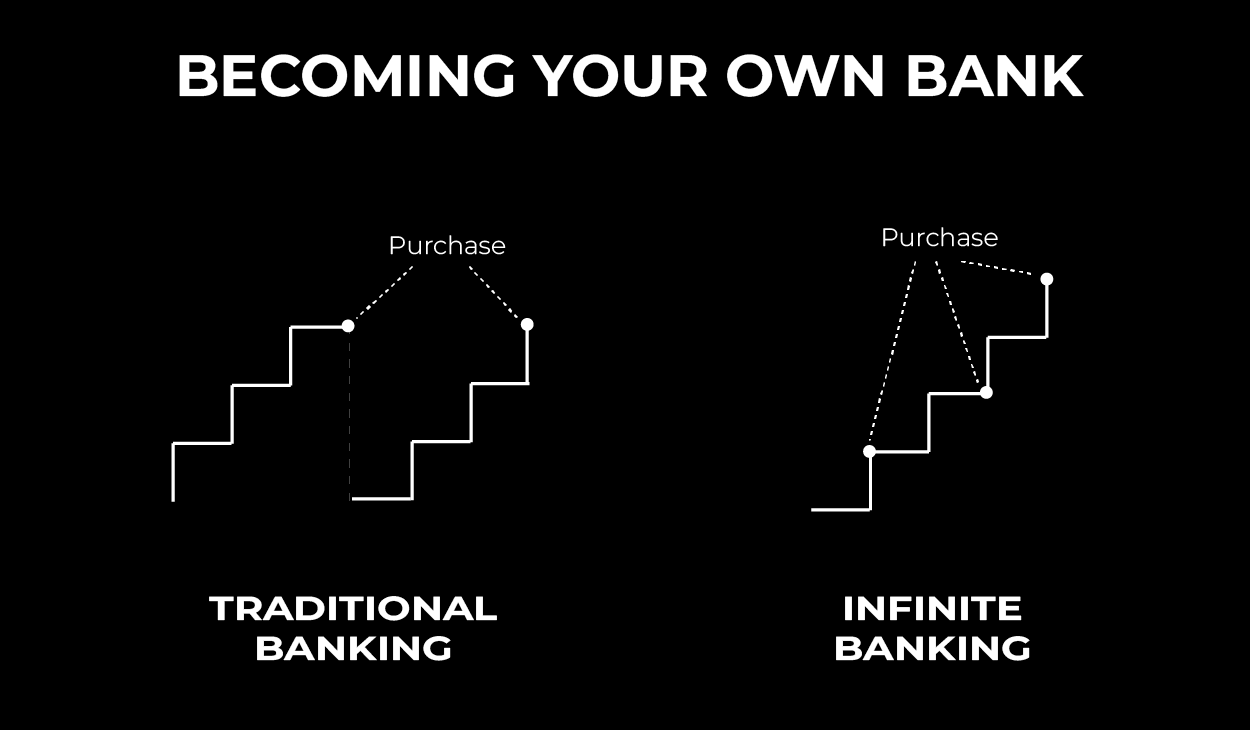

The approach has its very own benefits, yet it likewise has issues with high charges, intricacy, and a lot more, causing it being considered as a rip-off by some. Boundless banking is not the finest policy if you need just the financial investment element. The infinite financial idea focuses on the usage of entire life insurance policies as a monetary device.

A PUAR enables you to "overfund" your insurance policy right up to line of it coming to be a Customized Endowment Contract (MEC). When you utilize a PUAR, you rapidly increase your cash value (and your survivor benefit), thus raising the power of your "bank". Further, the even more cash money value you have, the greater your rate of interest and reward repayments from your insurer will certainly be.

With the surge of TikTok as an information-sharing system, financial advice and approaches have discovered an unique way of spreading. One such method that has been making the rounds is the infinite banking principle, or IBC for brief, garnering endorsements from stars like rapper Waka Flocka Fire - Financial leverage with Infinite Banking. Nevertheless, while the approach is presently prominent, its roots trace back to the 1980s when financial expert Nelson Nash introduced it to the world.

How does Wealth Building With Infinite Banking compare to traditional investment strategies?

Within these policies, the money worth expands based upon a rate set by the insurance firm. As soon as a significant cash worth accumulates, insurance holders can obtain a money worth lending. These loans vary from standard ones, with life insurance policy serving as collateral, suggesting one could lose their protection if loaning exceedingly without adequate money worth to sustain the insurance coverage costs.

And while the attraction of these plans is noticeable, there are innate limitations and dangers, requiring thorough money worth monitoring. The strategy's legitimacy isn't black and white. For high-net-worth people or company owner, specifically those utilizing strategies like company-owned life insurance policy (COLI), the advantages of tax obligation breaks and substance growth can be appealing.

The appeal of boundless financial doesn't negate its difficulties: Price: The foundational demand, an irreversible life insurance plan, is more expensive than its term counterparts. Eligibility: Not everyone receives entire life insurance coverage as a result of extensive underwriting procedures that can exclude those with particular wellness or way of living problems. Complexity and threat: The elaborate nature of IBC, paired with its threats, may hinder several, especially when simpler and much less high-risk alternatives are offered.

What are the risks of using Self-financing With Life Insurance?

Alloting around 10% of your monthly revenue to the plan is simply not practical for a lot of individuals. Utilizing life insurance coverage as an investment and liquidity resource needs discipline and surveillance of policy cash value. Consult an economic advisor to identify if unlimited banking lines up with your concerns. Part of what you check out below is just a reiteration of what has currently been stated above.

Prior to you obtain on your own right into a situation you're not prepared for, recognize the adhering to first: Although the idea is commonly sold as such, you're not actually taking a funding from on your own. If that held true, you wouldn't have to settle it. Instead, you're borrowing from the insurance coverage business and need to settle it with passion.

Some social media messages advise using cash value from whole life insurance coverage to pay down credit history card debt. When you pay back the lending, a section of that passion goes to the insurance policy company.

What is Leverage Life Insurance?

For the first numerous years, you'll be settling the commission. This makes it extremely hard for your policy to collect value during this time around. Whole life insurance policy prices 5 to 15 times extra than term insurance policy. The majority of people simply can't manage it. So, unless you can manage to pay a couple of to a number of hundred bucks for the following decade or even more, IBC won't benefit you.

Not everyone should count only on themselves for monetary security. Infinite Banking for financial freedom. If you require life insurance, here are some important pointers to take into consideration: Think about term life insurance coverage. These plans supply insurance coverage during years with significant economic commitments, like mortgages, pupil lendings, or when caring for young children. Make certain to look around for the best rate.

Can anyone benefit from Bank On Yourself?

Visualize never ever needing to worry about small business loan or high rate of interest prices again. Suppose you could obtain cash on your terms and build riches at the same time? That's the power of limitless banking life insurance policy. By leveraging the cash money worth of whole life insurance IUL plans, you can expand your wide range and borrow cash without counting on standard banks.

There's no collection financing term, and you have the liberty to choose the repayment schedule, which can be as leisurely as settling the finance at the time of death. This adaptability includes the maintenance of the finances, where you can choose interest-only payments, maintaining the loan equilibrium flat and manageable.

What are the tax advantages of Wealth Building With Infinite Banking?

Holding money in an IUL fixed account being credited passion can typically be better than holding the money on deposit at a bank.: You've constantly desired for opening your very own bakeshop. You can borrow from your IUL plan to cover the first expenditures of leasing a space, buying devices, and hiring personnel.

Personal financings can be acquired from conventional banks and credit rating unions. Right here are some bottom lines to think about. Charge card can offer a flexible means to obtain cash for extremely short-term periods. Nonetheless, obtaining cash on a bank card is generally very expensive with interest rate of rate of interest (APR) typically getting to 20% to 30% or more a year.

Latest Posts

Cash Flow Whole Life Insurance

Hybrid Debt & Mortgage Arbitrage, Become Your Own Bank

Cash Flow Banking Insurance