All Categories

Featured

Table of Contents

If you take a distribution versus your account before the age of 59, you'll likewise have to pay a 10% charge. The internal revenue service has enforced the MEC policy as a method to avoid individuals from skirting tax commitments. Boundless banking only works if the cash money worth of your life insurance coverage plan remains tax-deferred, so see to it you do not turn your policy into an MEC.

Once a cash money value insurance coverage account categorizes as an MEC, there's no method to reverse it back to tax-deferred standing. Limitless banking is a practical idea that supplies a variety of advantages. Here are several of the pros of this one-of-a-kind, personal finance banking system. A non-correlated asset is any asset not tied to the securities market.

You can profit of infinite banking with a variable universal life insurance policy plan or an indexed global life insurance policy. Since these types of policies tie to the stock market, these are not non-correlated assets. For your plan's money worth to be a non-correlated property, you will certainly need either entire life insurance policy or universal life insurance policy.

Before selecting a plan, figure out if your life insurance coverage business is a mutual company or otherwise, as just mutual business pay returns. The following time you require a large amount of cash to make a down repayment on a home, spend for university tuition for your youngsters, or fund a new financial investment You won't have to dip right into your savings account or search for lenders with low-interest rates.

What makes Cash Value Leveraging different from other wealth strategies?

By taking a financing from you rather than a typical lender, the debtor can save hundreds of dollars in interest over the life of the finance. (Simply be certain to bill them the very same rate of rate of interest that you need to repay to on your own. Or else, you'll take a financial hit).

It's simply an additional way to defer paying tax obligations on a portion of your earnings and develop an additional safeguard for on your own and your family members. There are some drawbacks to this financial method. As a result of the MEC legislation, you can not overfund your insurance plan way too much or too quickly. It can take years, if not years, to develop a high cash money value in your life insurance plan.

A life insurance plan connections to your health and life span. Depending on your clinical background and pre-existing problems, you may not qualify for an irreversible life insurance plan at all. With boundless banking, you can become your very own lender, obtain from on your own, and add cash value to an irreversible life insurance coverage policy that expands tax-free.

When you first hear concerning the Infinite Financial Concept (IBC), your first reaction could be: This appears as well excellent to be true - Borrowing against cash value. The problem with the Infinite Banking Concept is not the concept however those persons using an unfavorable review of Infinite Financial as a principle.

As IBC Authorized Practitioners through the Nelson Nash Institute, we believed we would address some of the top inquiries people search for online when finding out and comprehending everything to do with the Infinite Banking Concept. So, what is Infinite Banking? Infinite Banking was produced by Nelson Nash in 2000 and totally described with the magazine of his publication Becoming Your Own Banker: Open the Infinite Financial Idea.

What are the benefits of using Whole Life For Infinite Banking for personal financing?

You believe you are coming out economically in advance because you pay no passion, but you are not. With saving and paying cash money, you might not pay passion, but you are utilizing your money as soon as; when you spend it, it's gone for life, and you offer up on the possibility to earn life time substance passion on that cash.

Billionaires such as Walt Disney, the Rockefeller family members and Jim Pattison have leveraged the homes of whole life insurance policy that dates back 174 years. Also financial institutions make use of entire life insurance policy for the very same purposes.

Infinite Banking Retirement Strategy

It allows you to create wealth by fulfilling the financial feature in your own life and the ability to self-finance major lifestyle acquisitions and expenditures without interrupting the substance interest. One of the simplest means to consider an IBC-type taking part whole life insurance plan is it approaches paying a mortgage on a home.

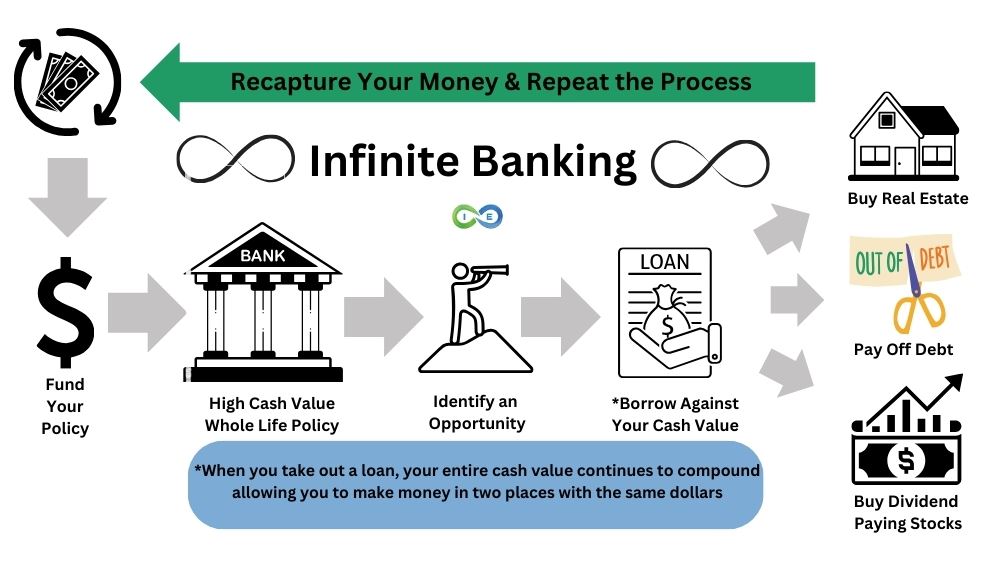

When you borrow from your taking part whole life insurance plan, the cash worth proceeds to expand uninterrupted as if you never obtained from it in the initial place. This is since you are making use of the cash money value and death advantage as security for a financing from the life insurance policy business or as collateral from a third-party lending institution (understood as collateral borrowing).

That's why it's necessary to collaborate with a Licensed Life insurance policy Broker authorized in Infinite Financial who structures your taking part entire life insurance policy policy appropriately so you can stay clear of unfavorable tax ramifications. Infinite Banking as a financial technique is except everybody. Below are a few of the pros and cons of Infinite Financial you need to seriously think about in making a decision whether to move on.

Our recommended insurance carrier, Equitable Life of Canada, a mutual life insurance policy business, focuses on taking part whole life insurance coverage plans particular to Infinite Banking. Likewise, in a mutual life insurance policy firm, insurance holders are thought about business co-owners and obtain a share of the divisible surplus generated every year via dividends. We have a range of carriers to select from, such as Canada Life, Manulife and Sunlight Lifedepending on the needs of our clients.

How can Financial Independence Through Infinite Banking reduce my reliance on banks?

Please likewise download our 5 Leading Concerns to Ask A Boundless Financial Agent Prior To You Employ Them. For more details about Infinite Financial browse through: Please note: The product given in this newsletter is for educational and/or instructional objectives only. The details, viewpoints and/or views shared in this e-newsletter are those of the authors and not always those of the supplier.

Latest Posts

Cash Flow Whole Life Insurance

Hybrid Debt & Mortgage Arbitrage, Become Your Own Bank

Cash Flow Banking Insurance